User Tag List

Risultati da 521 a 530 di 632

Discussione: Focus - Fine del predominio del dollaro.

-

06-07-15, 00:30 #521Forumista senior

- Data Registrazione

- 06 Apr 2015

- Messaggi

- 3,053

-

- 1,327

-

- 798

- Mentioned

- 3 Post(s)

- Tagged

- 0 Thread(s)

Re: Focus - Fine del predominio del dollaro.

Re: Focus - Fine del predominio del dollaro.

-

18-07-15, 23:14 #522Sospeso/a

- Data Registrazione

- 20 Nov 2009

- Località

- Miami, FL, USA

- Messaggi

- 94,893

-

- 1,916

-

- 8,337

- Mentioned

- 651 Post(s)

- Tagged

- 3 Thread(s)

Re: Focus - Fine del predominio del dollaro.

Re: Focus - Fine del predominio del dollaro.

Interessante articolo dal The Diplomat:

RMB Internationalization and US Economic Leadership: Reforms and Rebalance

Insights from Edmund Moy

By Mercy A. Kuo and Angelica O. Tang

July 14, 2015

The Rebalance authors Mercy Kuo and Angie Tang regularly engage subject-matter experts, policy practitioners, and strategic thinkers across the globe for their diverse insights into the U.S. rebalance to Asia. This conversation withEdmund Moy – Chief Strategist for Fortress Gold Group, 38th Director of the U.S. Mint (2006-2011), and author of American Gold and Platinum Eagles: A Guide to the U.S. Bullion Coin Program – is the tenth in “The Rebalance Insight Series.”

The International Monetary Fund (IMF) is currently considering whether or not to recognize the Chinese currency – yuan or renminbi (RMB) – as an official reserve currency to be included in the Special Drawing Rights (SDR) along with the dollar, euro, yen and sterling. Eswar Prasad, the former head of the IMF’s China division recently stated, “The IMF’s imprimatur is nice to have but ultimately it is market forces that will drive the renminbi’s adoption as a reserve currency.” Please provide your perspective on key factors driving the IMF’s decision-making process.

The IMF has stated that it is more a matter of when, not if, the yuan should be included in the IMF’s reserve currency basket. Whether the IMF decides to recognize the RMB as a global reserve currency now or later depends on two key factors. First, China must meet the IMF condition that it is a large exporter, which by all counts, China does. Second, China’s RMB must be “freely usable.” On this point, China has made great strides to meet this condition. For example, China has dramatically increased the amount of its trade paid for in yuan and started opening its borders to outside investment. But, the United States still has some concerns over the slow and limited reforms. U.S. opinion is important to this decision because it controls enough of the votes to essentially have veto power.

What is the RMB’s role in the international monetary system?

Because of the size of its economy and the large volume of its exports, the RMB’s role in the international monetary system is growing in importance. For example, almost 25 percent of China’s trade is now settled in yuan, up from 0.02 percent just five years ago. However, to put that in perspective, it is still a very small amount compared to the U.S. dollar’s role in the international monetary system. It will take China years, if not decades, to even rise to capture a statistically meaningful share.

Will internationalization of the RMB necessitate greater liberalization of China’s monetary policy, including greater regulatory transparency? What political and legal reforms would be required?

That is the big question. It appears that China might liberalize enough to be accepted as a peer in today’s global economic leadership. But China has hinted that liberalization is primarily a Western way and that the Chinese way of “state capitalism” is ultimately better. I personally believe in the superiority of the free market over a command economy, and as China liberalizes, it will be difficult to reverse those reforms, which would include a market-determined exchange rate, normalization of interest rates, stronger financial regulation and supervision, and capital-account liberalization.

What is the potential impact of the RMB’s internationalization on the U.S. rebalance to Asia?

Recognizing the RMB as a global reserve currency acknowledges China’s ascendancy as world economic superpower and will boost China’s efforts to project its power internationally. It will also give them increased leverage, especially in Asia and make the U.S. rebalance to Asia much more difficult. It should also be said that the U.S. rebalance to Asia has mostly been rhetorical, while China has been actively strengthening its economic influence and expanding its military presence in Asia.

How should U.S. presidential contenders explain the implications of the RMB as an emerging global currency to the American electorate?

I think there are three takeaways for U.S. presidential contenders. First, the problem is less with the ascendancy of the RMB and more with state of U.S. global economic leadership. Second, China has a long-term plan to supplant U.S. global leadership and is executing it regardless of short-term distractions. For example, China has also helped formed the New Development Bank and the Asian Infrastructure Investment Bank as alternatives to the U.S.-dominated World Bank and IMF, and the Japan-led Asian Development Bank. Third, a strong U.S. economy is the foundation for a strong U.S. foreign policy. The RMB becomes much less of an issue with an U.S. economy growing at 4 percent a year.

Mercy A. Kuo is an advisory board member of CHINADebate and was previously director of the Southeast Asia Studies and Strategic Asia Programs at the National Bureau of Asian Research. Angie O. Tang is Senior Advisor of Asia Value Advisors, a leading venture philanthropy advisory firm based in Hong Kong.

RMB Internationalization and US Economic Leadership: Reforms and Rebalance | The Diplomat

Tralasciando quindi le doamnde e le ripsoste basate sulle opinioni, cmq interessanti, vediamo questo dato:

almost 25 percent of China’s trade is now settled in yuan, up from 0.02 percent just five years ago. However, to put that in perspective, it is still a very small amount compared to the U.S. dollar’s role in the international monetary system. It will take China years, if not decades, to even rise to capture a statistically meaningful share.

Tutti i discorsi sul fatto che "Se iniziano a ocmmerciare con questo o quello... il $ muore"... ora, gia' OGGI la Cina per 1/4 dei suoi commerci (e la Cina e' la prima esportatrice e seconda importatrice al mondo), PAGA e RICEVE RMB (Yuan), nonostante cio', il ruolo dello Yuan a livello mondiale ha un peso del 2 e qualcosa %...

Come indicato piu' volte, entro un lustro potremmo vedere uno Yuan scalare poisizioni e prendere il posto dello Yen e/o Sterlina, quindi arrivare ad un 8/10% dei volumi, ma le fantasie dei MegaFantablogs (Come del resto anche le riserve aueree finalmente svelate indicano) sono fantasie alla quarta potenza.

-

19-07-15, 18:03 #523email non funzionante

- Data Registrazione

- 04 May 2015

- Messaggi

- 988

-

- 119

-

- 378

- Mentioned

- 0 Post(s)

- Tagged

- 0 Thread(s)

-

23-07-15, 23:02 #524Sospeso/a

- Data Registrazione

- 20 Nov 2009

- Località

- Miami, FL, USA

- Messaggi

- 94,893

-

- 1,916

-

- 8,337

- Mentioned

- 651 Post(s)

- Tagged

- 3 Thread(s)

Re: Focus - Fine del predominio del dollaro.

Re: Focus - Fine del predominio del dollaro.

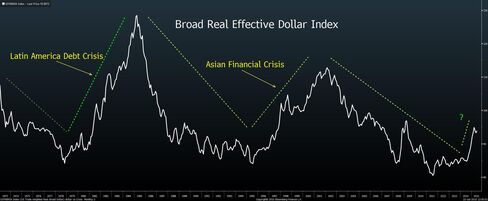

This Dollar Chart Is Bad News for Emerging Markets

Commodities crash or credit crunch, a rising U.S. dollar doesn’t look good for EM

If history is any guide, emerging markets are headed for trouble as the dollar strengthens.

A soaring U.S. currency, coupled with higher interest rates and lower commodity prices, triggered debt defaults in Latin America in the 1980s. A decade later, the dollar’s appreciation forced Asian countries from Thailand to Malaysia to drop their peg to the greenback, and threw the region into a crisis.

As in the past, a strong dollar and the prospect for higher borrowing costs in the U.S. are now lowering commodity prices, reducing exports from countries such as Brazil, South Africa, and Russia. It’s also luring capital away from developing nations, slowing their credit expansion and dragging down economic growth, according to Julian Brigden, managing partner at research firm Macro Intelligence 2 Partners.

“The symptoms of an emerging-market crisis are numerous, but the cause is always a rising dollar,” Brigden said in a July 22 report. “In Asia, especially China, adherence to the dollar risks a credit crunch and slower growth. For commodity producers, falling demand and prices suggest the pain is just starting.”

Just how far could the dollar rise?

A Federal Reserve gauge of the inflation-adjusted dollar exchange rate against major U.S. trading partners shows the greenback has so far gained 17 percent from an all-time low in July 2011. In the previous two dollar-rising cycles, the currency gained 53 percent from 1978 to 1985, and then 34 percent in the seven years through 2002.

This Dollar Chart Is*Bad News for Emerging Markets - Bloomberg BusinessUltima modifica di Amati75; 23-07-15 alle 23:03

-

23-07-15, 23:04 #525email non funzionante

- Data Registrazione

- 02 May 2012

- Messaggi

- 49,683

-

- 1,679

-

- 9,040

- Mentioned

- 307 Post(s)

- Tagged

- 6 Thread(s)

Re: Focus - Fine del predominio del dollaro.

Re: Focus - Fine del predominio del dollaro.

ma questo dollaro quando è che finisce?

ed inoltre, auqlcuno sa dirmi da cosa diovrebbe essere sostituito?

-

26-07-15, 17:04 #526Sospeso/a

- Data Registrazione

- 20 Nov 2009

- Località

- Miami, FL, USA

- Messaggi

- 94,893

-

- 1,916

-

- 8,337

- Mentioned

- 651 Post(s)

- Tagged

- 3 Thread(s)

-

31-07-15, 21:12 #527Sospeso/a

- Data Registrazione

- 20 Nov 2009

- Località

- Miami, FL, USA

- Messaggi

- 94,893

-

- 1,916

-

- 8,337

- Mentioned

- 651 Post(s)

- Tagged

- 3 Thread(s)

Re: Focus - Fine del predominio del dollaro.

Re: Focus - Fine del predominio del dollaro.

Ed eccoci nuovamente... al consueto appuntamento mensile con la "fine del Dollaro".... i dati aggiornati dello Swift per i volumi delle varie valute nel mercato del Forex:

USD 45.1%

EURO 27.90%

Sterlina 7.99%

YEN 2.85%

YUAN (RMB) 2.09%

....

Rublo 0.22%

http://www.swift.com/assets/swift_co...2015_final.pdf

Ed anche per questo mese la "Fine del dollaro" e' reinviata.

-

01-08-15, 03:29 #528email non funzionante

- Data Registrazione

- 30 Nov 2009

- Località

- new york

- Messaggi

- 126,274

-

- 17

-

- 10,960

- Mentioned

- 1258 Post(s)

- Tagged

- 9 Thread(s)

Re: Focus - Fine del predominio del dollaro.

Re: Focus - Fine del predominio del dollaro.

Aveva pure previsto il boom dell' oro !!!!!!

ahahhahahhahahahahhahahhahahahhahahahhahahhahahahh ahahahhhhah

La crisi dell'oro - Il Post

-

01-08-15, 03:30 #529email non funzionante

- Data Registrazione

- 30 Nov 2009

- Località

- new york

- Messaggi

- 126,274

-

- 17

-

- 10,960

- Mentioned

- 1258 Post(s)

- Tagged

- 9 Thread(s)

-

09-08-15, 10:41 #530Forumista

- Data Registrazione

- 14 Jul 2015

- Messaggi

- 144

-

- 1

-

- 15

- Mentioned

- 0 Post(s)

- Tagged

- 0 Thread(s)

Re: Focus - Fine del predominio del dollaro.

Re: Focus - Fine del predominio del dollaro.

Questo signore se fosse meno servo dell'Occidente (USA) avrebbe parlato di esaudita richiesta da parte della Crimea al ritorno in casa propria con la propria lingua cioè in Russia dopo il colpo di stato nazista in Ucraina che addirittura mette al bando il partito che scacciò i nazisti dalla propria casa, e lui il signore chiama invasione dell'armata rossa e non AIUTO.

Rispondi Citando

Rispondi Citando

):

):